Sensitivity Analysis Follow 19k Reduced Cost Shadow Price Sensitivity analysis gives you insight in how the optimal solution changes when you change the coefficients of the model. After the solver found a solution, you can create a sensitivity report. Before you click OK, select Sensitivity from the Reports section. Below you can find the.

In the Add-Ins available box, select the Solver Add-In check box, and then click OK. If Solver Add-in is not listed in the Add-Ins available box, click Browse to locate the add-in. If you get a prompt that the Solver add-in is not currently installed on your computer, click Yes in the dialog box to install it. After you load the Solver add-in, the Solver button is available on the Data tab. If solver says anything else, it did NOT find a solution-see Tips below. After Solver finds a solution, click to select the Answer and/or Sensitivity reports in the Reports section as required for your assignment. Do not change any other settings. Click OK, and Solver will create new spreadsheet(s) containing the reports. After the solver found a solution, you can create a sensitivity report. Before you click OK, select Sensitivity from the Reports section. Below you can find the optimal solution and the sensitivity report.

How to do sensitivity analysis with data table in Excel?

Let’s say you have a chair shop and sold chairs as below screenshot shown. Now, you want to analyze how the price and sales volume affect the profit of this shop simultaneously, so that you can adjust your sales strategy for better profit. Actually, the sensitivity analysis can solve your problem.

Do sensitivity analysis with data table in Excel

This method will apply the Data Table feature to do a sensitivity analysis in Excel. Please do as follows:

1. Finish the Profit & Loss Statement table as below screenshot shown:

(1) In Cell B11, Please type the formula =B4*B3;

(2) In Cell B12, please type the formula =B5*B3;

(3) In Cell B13, please type the formula =B11-B12;

(4) In Cell B14, please type the formula =B13-B6-B7.

2. Prepare the sensitivity analysis table as below screenshot shown:

(1) In Range F2:K2, please type the sales volumes from 500 to 1750;

(2) In Range E3:E8, please type the prices from 75 to 200;

(3) In the Cell E2, please type the formula =B14

3. Select the Range E2:K8, and click Data > What-If Analysis > Data Table. See screenshot:

4. In the popping out Data Table dialog box, please (1) in the Row input cell box specify the cell with chairs sales volume (B3 in my case), (2) in the Column input cell box specify the cell with chair price (B4 in my case), and then (3) click the OK button. See screenshot:

5. Now the sensitivity analysis table is created as below screenshot shown.

You can easily get how the profit changes when both sales and price volume change. For example, when you sold 750 chairs at price of $125.00, the profit changes to $-3750.00; while when you sold 1500 chairs at price of $100.00, the profit changes to $15000.00.

Related articles:

The Best Office Productivity Tools

Kutools for Excel Solves Most of Your Problems, and Increases Your Productivity by 80%

- Reuse: Quickly insert complex formulas, charts and anything that you have used before; Encrypt Cells with password; Create Mailing List and send emails...

- Super Formula Bar (easily edit multiple lines of text and formula); Reading Layout (easily read and edit large numbers of cells); Paste to Filtered Range...

- Merge Cells/Rows/Columns without losing Data; Split Cells Content; Combine Duplicate Rows/Columns... Prevent Duplicate Cells; Compare Ranges...

- Select Duplicate or Unique Rows; Select Blank Rows (all cells are empty); Super Find and Fuzzy Find in Many Workbooks; Random Select...

- Exact Copy Multiple Cells without changing formula reference; Auto Create References to Multiple Sheets; Insert Bullets, Check Boxes and more...

- Extract Text, Add Text, Remove by Position, Remove Space; Create and Print Paging Subtotals; Convert Between Cells Content and Comments...

- Super Filter (save and apply filter schemes to other sheets); Advanced Sort by month/week/day, frequency and more; Special Filter by bold, italic...

- Combine Workbooks and WorkSheets; Merge Tables based on key columns; Split Data into Multiple Sheets; Batch Convert xls, xlsx and PDF...

- More than 300 powerful features. Supports Office/Excel 2007-2019 and 365. Supports all languages. Easy deploying in your enterprise or organization. Full features 30-day free trial. 60-day money back guarantee.

Office Tab Brings Tabbed interface to Office, and Make Your Work Much Easier

- Enable tabbed editing and reading in Word, Excel, PowerPoint, Publisher, Access, Visio and Project.

- Open and create multiple documents in new tabs of the same window, rather than in new windows.

- Increases your productivity by 50%, and reduces hundreds of mouse clicks for you every day!

or post as a guest, but your post won't be published automatically.

- To post as a guest, your comment is unpublished.Nice. Thank you

- To post as a guest, your comment is unpublished.I built an Excel sensitivity analysis tool - https://causal.app/sensitivity. It figures out which variables in your model are the most important, and shows you what happens if you vary each variable one by one.

- To post as a guest, your comment is unpublished.Cell A11 should be Sales; Cell A12 should be Cost of Sales; Cell A13 should be Gross Profit while Cell A14 should be Operating Profit.

Celestine B. Etouwem.

J E Beasley

OR-Notes are a series of introductory notes on topics that fall under the broad heading of the field of operations research (OR). They were originally used by me in an introductory OR course I give at Imperial College. They are now available for use by any students and teachers interested in OR subject to the following conditions.

A full list of the topics available in OR-Notes can be found here.

Linear programming - sensitivity analysis - using Solver

Recall the production planning problem concerned with four variants of the same product which we formulated before as an LP. To remind you of it we repeat below the problem and our formulation of it.

Production planning problem

A company manufactures four variants of the same product and in the final part of the manufacturing process there are assembly, polishing and packing operations. For each variant the time required for these operations is shown below (in minutes) as is the profit per unit sold.

- Given the current state of the labour force the company estimate that, each year, they have 100000 minutes of assembly time, 50000 minutes of polishing time and 60000 minutes of packing time available. How many of each variant should the company make per year and what is the associated profit?

- Suppose now that the company is free to decide how much time to devote to each of the three operations (assembly, polishing and packing) within the total allowable time of 210000 (= 100000 + 50000 + 60000) minutes. How many of each variant should the company make per year and what is the associated profit?

Production planning solution

Variables

Let:

xi be the number of units of variant i (i=1,2,3,4) made per year

Tass be the number of minutes used in assembly per year

Tpol be the number of minutes used in polishing per year

Tpac be the number of minutes used in packing per year

where xi >= 0 i=1,2,3,4 and Tass, Tpol, Tpac >= 0

Constraints

(a) operation time definition

Tass = 2x1 + 4x2 + 3x3 + 7x4 (assembly)

Tpol = 3x1 + 2x2 + 3x3 + 4x4 (polish)

Tpac = 2x1 + 3x2 + 2x3 + 5x4 (pack)

(b) operation time limits

The operation time limits depend upon the situation being considered. In the first situation, where the maximum time that can be spent on each operation is specified, we simply have:

Tass <= 100000 (assembly)

Tpol <= 50000 (polish)

Tpac <= 60000 (pack)

In the second situation, where the only limitation is on the total time spent on all operations, we simply have:

Tass + Tpol + Tpac <= 210000 (total time)

Objective

Presumably to maximise profit - hence we have

maximise 1.5x1 + 2.5x2 + 3.0x3 + 4.5x4

which gives us the complete formulation of the problem.

Solution - using Solver

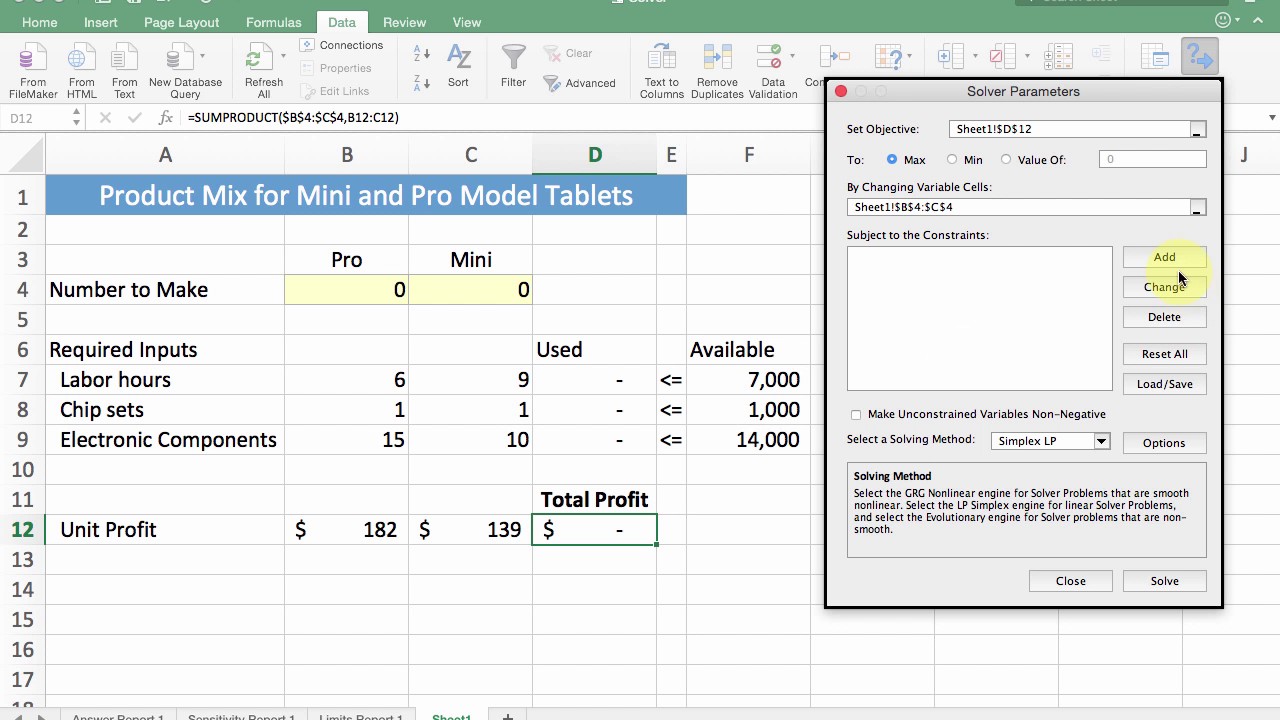

Below we solve this LP with the Solver add-in that comes with Microsoft Excel.

If you click here you will be able to download an Excel spreadsheet called lp.xls that already has the LP we are considering set up.

Look at Sheet A in lp.xls and to use Solver do Tools and then Solver. In the version of Excel I am using (different versions of Excel have slightly different Solver formats) you will get the Solver model as below:

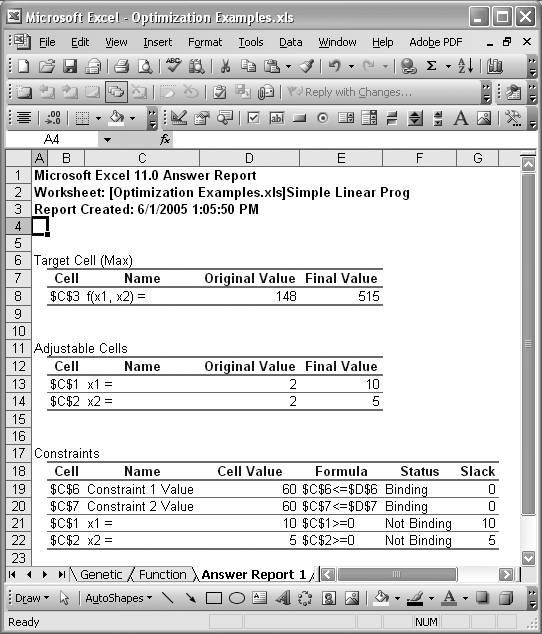

but where now we have highlighted (clicked on) two of the Reports available - Answer and Sensitivity. Click OK and you will find that two new sheets have been added to the spreadsheet - an Answer Report and a Sensitivity Report.

As these reports are indicative of the information that is commonly available when we solve a LP via a computer we shall deal with each of them in turn.

Answer Report

The answer report can be seen below:

This is the most self-explanatory report.

We can see that the optimal solution to the LP has value 58000 (£) and that Tass=82000, Tpol=50000, Tpac=60000, X1=0, X2=16000, X3=6000 and X4=0.

Note that we had three constraints for total assembly, total polishing and total packing time in our LP. The assembly time constraint is declared to be 'Not Binding' whilst the other two constraints are declared to be 'Binding'. Constraints with a 'Slack' value of zero are said to be tight or binding in that they are satisfied with equality at the LP optimal. Constraints which are not tight are called loose or not binding.

Sensitivity Report

The sensitivity report can be seen below:

This sensitivity report provides us with information relating to:

- changing the objective function coefficient for a variable

- forcing a variable which is currently zero to be non-zero

- changing the right-hand side of a constraint.

We deal with each of these in turn, and note here that the analysis presented below ONLY applies for a single change, if two or more things change then we effectively need to resolve the LP.

Changing the objective function coefficient for a variable

To illustrate this suppose we vary the coefficient of X2 in the objective function. How will the LP optimal solution change?

Currently X1=0, X2=16000, X3=6000 and X4=0. The current solution value for X2 of 16000 is in cell B3 and the current objective function coefficient for X2 is 2.5. The Allowable Increase/Decrease columns tell us that, provided the coefficient of X2 in the objective function lies between 2.5+2 = 4.5 and 2.5 - 0.142857143 = 2.3571 (to four decimal places), the values of the variables in the optimal LP solution will remain unchanged. Note though that the actual optimal solution value will change as the objective function coefficient of X2 is changing.

In terms of the original problem we are effectively saying that the decision to produce 16000 of variant 2 and 6000 of variant 3 remains optimal even if the profit per unit on variant 2 is not actually 2.5 (but lies in the range 2.3571 to 4.50). Similar conclusions can be drawn about X1, X3 and X4.

Forcing a variable which is currently zero to be non-zero

For the variables, the Reduced Cost column gives us, for each variable which is currently zero (X1 and X4), an estimate of how much the objective function will change if we make (force) that variable to be non-zero. Note here that the value in the Reduced Cost column for a variable is often called the 'opportunity cost' for the variable.

Hence we have the table

where we ignore the sign of the reduced cost when constructing the above table. The objective function will always get worse (go down if we have a maximisation problem, go up if we have a minimisation problem) by at least this estimate. The larger A or B are the more inaccurate this estimate is of the exact change that would occur if we were to resolve the LP with the corresponding constraint for the new value of X1 or X4 added.

Note here than an alternative (and equally valid) interpretation of the reduced cost is the amount by which the objective function coefficient for a variable needs to change before that variable will become non-zero.

Hence for variable X1 the objective function needs to change by 1.5 (increase since we are maximising) before that variable becomes non-zero. In other words, referring back to our original situation, the profit per unit on variant 1 would need to increase by 1.5 before it would be profitable to produce any of variant 1. Similarly the profit per unit on variant 4 would need to increase by 0.2 before it would be profitable to produce any of variant 4.

Changing the right-hand side of a constraint

For each constraint the column headed Shadow Price tells us exactly how much the objective function will change if we change the right-hand side of the corresponding constraint within the limits given in the Allowable Increase/Decrease columns

Hence we can form the table

For example for the polish constraint, provided the right-hand side of that constraint remains between 50000 + 40000 =90000 and 50000 - 10000 = 40000 the objective function change will be exactly 0.80[change in right-hand side from 50000].

The direction of the change in the objective function (up or down) depends upon the direction of the change in the right-hand side of the constraint and the nature of the objective (maximise or minimise).

To decide whether the objective function will go up or down use:

- constraint more (less) restrictive after change in right-hand side implies objective function worse (better)

- if objective is maximise (minimise) then worse means down (up), better means up (down)

Hence

- if you had an extra 100 hours to which operation would you assign it?

- if you had to take 50 hours away from polishing or packing which one would you choose?

- what would the new objective function value be in these two cases?

The value in the column headed Shadow Price for a constraint is often called the 'marginal value' or 'dual value' for that constraint.

Note that, as would seem logical, if the constraint is loose the shadow price is zero (as if the constraint is loose a small change in the right-hand side cannot alter the optimal solution).

Comments

- Different LP packages have different formats for input/output but the same information as discussed above is still obtained.

- You may have found the above confusing. Essentially the interpretation of LP output is something that comes with practice.

- Much of the information obtainable (as discussed above) as a by-product of the solution of the LP problem can be useful to management in estimating the effect of changes (e.g. changes in costs, production capacities, etc) without going to the hassle/expense of resolving the LP.

- This sensitivity information gives us a measure of how robust the solution is i.e. how sensitive it is to changes in input data.

Solver Add In Excel Mac

Note here that, as mentioned above, the analysis given above relating to:

- changing the objective function coefficient for a variable; and

- forcing a variable which is currently zero to be non-zero; and

- changing the right-hand side of a constraint

is only valid for a single change. If two (or more) changes are made the situation becomes more complex and it becomes advisable to resolve the LP.